Revised and Updated Labor Costs Still Tame

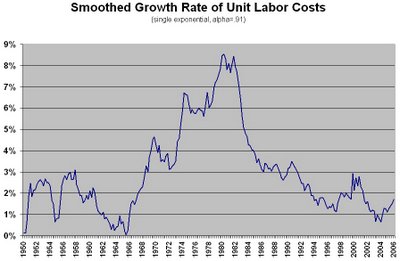

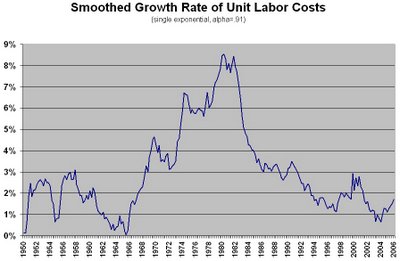

Some people will look at the new second quarter figure for unit labor cost in this morning’s productivity report and conclude that labor costs have become an inflation problem. Unit labor cost was up at 4% annual rate in the second quarter and up 3.1% from the same quarter a year ago. As I’ve said before, though, this series is volatile, and the appropriate way to analyze it is to smooth the quarterly changes. Taking into account the revisions and the latest update, my smoothed series now looks like this:

It stands at 1.7%, still quite close to the 1.5% center of the assumed hypothetical target range. In fact, on the off chance that the Fed really is targeting unit labor costs, let me offer my personal congratulations to each of the FOMC members right now for coming so close. Let me also say that, if I believed that the Fed were targeting unit labor costs, I would be pretty confident that we would not see any further interest rate increases, at least not in the next 3 months (and certainly not this afternoon). When the economy is facing a possible recession and your target number is right where you want it, you don’t push things. (As it is, I don’t think the Fed is targeting unit labor costs, and I think there’s actually a significant chance of an increase this afternoon, contrary to the current consensus.)

You might want to look more closely at the second quarter figure. One reason it was so high is that productivity growth was slow. In general, one wouldn’t expect that weak productivity growth in a particular quarter means we should expect weak productivity growth in the future. Applying my smoother to productivity growth, I get a rate of 2.7%, compared to the 1.1% reported for the second quarter. So if we use trend productivity growth instead of the quarterly observation, that shaves 1.6 percentage points off that ugly 4% and leaves us with 2.4%, a much less alarming number.

The other side of the picture is compensation growth. Nominal hourly compensation grew quite rapidly (5.1% annual rate) in the second quarter. Does anyone expect it to keep growing at that rate? I certainly don’t, not after the recent huge drop in help wanted advertising.

It stands at 1.7%, still quite close to the 1.5% center of the assumed hypothetical target range. In fact, on the off chance that the Fed really is targeting unit labor costs, let me offer my personal congratulations to each of the FOMC members right now for coming so close. Let me also say that, if I believed that the Fed were targeting unit labor costs, I would be pretty confident that we would not see any further interest rate increases, at least not in the next 3 months (and certainly not this afternoon). When the economy is facing a possible recession and your target number is right where you want it, you don’t push things. (As it is, I don’t think the Fed is targeting unit labor costs, and I think there’s actually a significant chance of an increase this afternoon, contrary to the current consensus.)

You might want to look more closely at the second quarter figure. One reason it was so high is that productivity growth was slow. In general, one wouldn’t expect that weak productivity growth in a particular quarter means we should expect weak productivity growth in the future. Applying my smoother to productivity growth, I get a rate of 2.7%, compared to the 1.1% reported for the second quarter. So if we use trend productivity growth instead of the quarterly observation, that shaves 1.6 percentage points off that ugly 4% and leaves us with 2.4%, a much less alarming number.

The other side of the picture is compensation growth. Nominal hourly compensation grew quite rapidly (5.1% annual rate) in the second quarter. Does anyone expect it to keep growing at that rate? I certainly don’t, not after the recent huge drop in help wanted advertising.

Labels: data, economics, inflation, labor, macroeconomics, US economic outlook, wages

12 Comments:

Knzn sweet heart,

Expecting a sumptuous FED decision post and its impact on the dollar.

You are doing a lovely job on this blog.

Keep it up.

Cheerio

Productivity growth lagged two quarters is a great leading indicator of real gdp growth --

compare the change in the y/y ch: of the two series.

But productivity growth implies a moderate slowdown in the second half and virtually no risk of a recession.

KNZN, I applaud your thoughtful analysis. You have no idea how many research reports came my way (I read a lot them) saying that productivity growth slowed. Not a single one mentioned how volatile the series is. Even the fed removed productivity growth from their statement. Do you think they are going to put it back in once productivity growth spikes back up?

Spencer, I’m familiar with the typical business cycle pattern of productivity (because businesses respond initially to changes in demand by adjusting production without adjusting employment), but I’m not sure how you can say so confidently that productivity growth implies “virtually no risk of recession.” For example, productivity looked pretty good through the first half of 1990, but we had a recession in the second half: the productivity effect didn’t show up until the recession actually hit.

Knzn,

The Fed must have read your post and be convinced by your labor costs still tame argument - they stop raising the rate!

Just kidding :)

Nice analysis.

Oh, I forgot to ask you a question: now that the Fed stopped raising the interest rate, do you still think there will be a recession?

Jim Rogers said there would be a recession in a year. But since he admitted to Maria Bartiromo that he has been in short position in the market, I don't know how much I should trust his words.

Anonymous (9:19:25), As Spencer’s comment and my response suggest, I think it’s likely that this bad productivity number represents a cyclical phenomenon, in which case it may persist for another quarter or two as businesses adjust to lower-than-expected levels of demand. Ultimately, of course, they adjust by reducing employment, which puts downward pressure on wages, so that the weak productivity growth actually signals a disinflationary phenomenon rather than an inflationary one. (Productivity growth tends to rise above trend again during the early stages of a recovery, as firms adjust to higher-than-expected demand.) If this scenario plays out then productivity will turn out to be largely irrelevant to the Fed’s subsequent decisions, at least until the recovery comes.

yc, I still think there will be a severe slowdown, which may or may not officially qualify as a recession. Really, 25 basis points on the federal funds rate do not make a whole lot of difference. As I said in the preamble to my earlier post, the Fed might pause “because there is evidence that the hard landing is already beginning to play itself out.” And if the hard landing evidence starts to diminish without an improvement in inflation, I think the Fed will continue to tighten, most likely precipitating the hard landing anyway.

What bothered me about the report was that unit labor cost rose more then the deflator -- on a year over year basis they are now the same.

This seems inconsistent with the other reports that imply marginas and profits are still improving.

It makes me suspect that the 2nd Q gdp number and productivity will be revised higher.

It makes me suspect that the 2nd Q gdp number and productivity will be revised higher.

Why not just the deflator revised higher, or compensation revised lower?

酒店喝酒,禮服店,酒店小姐,酒店領檯,便服店,鋼琴酒吧,酒店兼職,酒店兼差,酒店打工,伴唱小姐,暑假打工,酒店上班,酒店兼職,ktv酒店,酒店,酒店公關,酒店兼差,酒店上班,酒店打工,禮服酒店,禮服店,酒店小姐,酒店兼差,暑假打工,酒店經紀,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,酒店傳播,酒店經紀人,酒店,酒店,酒店,酒店 ,禮服店 , 酒店小姐,酒店經紀,酒店兼差,暑假打工,招待所,酒店小姐,酒店兼差,寒假打工,酒店上班,暑假打工,酒店公關,酒店兼職,禮服店 , 酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工,酒店,酒店,酒店經紀,酒店領檯 ,禮服店 ,酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工, 酒店上班,禮服店 ,酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工, 酒店上班,禮服店 ,酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工, 酒店上班,酒店經紀,酒店經紀,酒店經紀

ghd

cheap ghd

ghd straighteners

Benefit GHD

GHD IV Salon Styler

GHD MINI STYLER

GHD Precious gift

Gold GHD

Kiss GHD

New pink GHD

Pink GHD

Pure Black GHD

Pure White GHD

Purple GHD

Rare GHD

Babyliss

polo boots

polo shoes

cheap straighteners

ghd hair straighteners

hair straighteners

Purple GHD IV Styler

Pure White GHD

Pure Black GHD

Pink GHD IV Styler

Kiss GHD Styler

Gray GHD IV Styler

Gold GHD IV Styler

GHD Rare Styler

GHD IV Salon Styler

Black GHD IV Styler

Benefit GHD IV Styler

herve leger

herve leger dresses

chanel

chanel iman

chanel outlet

chanel handbag

Chanel Wallet

Chanel Watch

chanel purse

Chanel Sunglasses

chanel bags

chanel earrings

chanel jewelry

chanel shoes

Post a Comment

<< Home