Is the Fed Doing Too Good a Job?

An anonymous commentator suggests that maybe the Fed, in overzealous attempts to stabilize the economy, is mistaking noise for information:

My first response is, it sure doesn’t seem very logical, does it? But my second response is that, nonetheless, I don’t think the Fed is behaving irrationally given its objectives and its risk aversion. And my third response is that maybe the Fed is being too picky about its objectives.

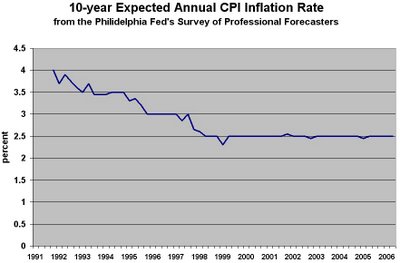

The Fed’s main objective is price stability. By “price” it means, perhaps, the market-based core personal consumption deflator (which I’ll call the MBCPCD). By “stability” it means, perhaps, an expected growth rate that remains in the range of 1.5 to 2.0 percent. The chart below suggests, however, that the Fed’s definition of stability is even more precise. Since it’s hard to find data on forecasts for the MBCPCD, the chart below looks at forecasts (at a 10-year horizon) for the consumer price index (CPI), which tends to rise a bit faster than the MBCPCD. The series charted is the median forecast from a regular survey of forecasters conducted by the Philadelphia Fed.

Clearly I’ve been watching too much Grey’s Anatomy, because I look at the right side of this chart and think, “Time of death?” Inflation expectations used to be somewhat volatile, but the Fed has apparently succeeded in killing that volatility. Over the past 7 years, the median forecast has had a range of 10 basis points. Ceteris paribus, that stability is undoubtedly a good thing. But…

Perfection generally doesn’t come cheap. Surely there were tradeoffs to be made, and it looks like the Fed traded everything it had for stable inflation expectations. Stable inflation expectations – to within 10 basis points – may be a pearl of great price, but I doubt they are worth quite as much as the Kingdom of Heaven.

To take the most straightforward – though probably not the most important – example, surely the Fed could have made interest rates a little more stable without letting inflation expectations go too far out of bounds. I admit, I was cheering on the Fed’s antideflation policy in 2002 and 2003, but looking at this chart now, I’m thinking, surely the federal funds rate could have stopped at 1.5%, even at the cost of letting the CPI expectation fall to 2.4% or even (gasp!) 2.35%. And surely this year, it could have stopped at 4.5%, even if that meant markets would anticipate 2.6% or 2.65% inflation.

It doesn't seem logical, to me, that deflation could have been a threat only a couple years ago whereas now the discussion is inflation…

My first response is, it sure doesn’t seem very logical, does it? But my second response is that, nonetheless, I don’t think the Fed is behaving irrationally given its objectives and its risk aversion. And my third response is that maybe the Fed is being too picky about its objectives.

The Fed’s main objective is price stability. By “price” it means, perhaps, the market-based core personal consumption deflator (which I’ll call the MBCPCD). By “stability” it means, perhaps, an expected growth rate that remains in the range of 1.5 to 2.0 percent. The chart below suggests, however, that the Fed’s definition of stability is even more precise. Since it’s hard to find data on forecasts for the MBCPCD, the chart below looks at forecasts (at a 10-year horizon) for the consumer price index (CPI), which tends to rise a bit faster than the MBCPCD. The series charted is the median forecast from a regular survey of forecasters conducted by the Philadelphia Fed.

Clearly I’ve been watching too much Grey’s Anatomy, because I look at the right side of this chart and think, “Time of death?” Inflation expectations used to be somewhat volatile, but the Fed has apparently succeeded in killing that volatility. Over the past 7 years, the median forecast has had a range of 10 basis points. Ceteris paribus, that stability is undoubtedly a good thing. But…

Perfection generally doesn’t come cheap. Surely there were tradeoffs to be made, and it looks like the Fed traded everything it had for stable inflation expectations. Stable inflation expectations – to within 10 basis points – may be a pearl of great price, but I doubt they are worth quite as much as the Kingdom of Heaven.

To take the most straightforward – though probably not the most important – example, surely the Fed could have made interest rates a little more stable without letting inflation expectations go too far out of bounds. I admit, I was cheering on the Fed’s antideflation policy in 2002 and 2003, but looking at this chart now, I’m thinking, surely the federal funds rate could have stopped at 1.5%, even at the cost of letting the CPI expectation fall to 2.4% or even (gasp!) 2.35%. And surely this year, it could have stopped at 4.5%, even if that meant markets would anticipate 2.6% or 2.65% inflation.

Labels: economics, inflation, interest rates, macroeconomics, monetary policy

1 Comments:

"Stable inflation expectations – to within 10 basis points – may be a pearl of great price, but I doubt they are worth quite as much as the Kingdom of Heaven"

I learn a lot from and enjoy reading your insights.

Post a Comment

<< Home