Phillips Curve

In Arthur Laffer’s case, it might have been carelessness in the use of words, but the latest attack on the Phillips curve by Larry Kudlow (discussed by Mark Thoma and pgl) is unmistakably either disingenuous or ignorant. (I'd prefer not to use such inflammatory terms, but I just can't think of a nice way to say it.) I single out Larry Kudlow only because his is the most recent example. I’ve heard similar arguments in the past, and I’m never sure whether the people making the argument realize that they are attacking a straw man – a man made completely of straw, that is, with no hope of even finding the Yellow Brick Road. But it’s one or the other: either Larry Kudlow is trying to pull the wool over people’s eyes, or he is somehow unaware of the last 40 years of Phillips curve research.

His argument essentially goes like this: the Phillips curve is an inverse relationship between unemployment and inflation. What we observe, however, is that the relationship is positive, not inverse. Therefore the Phillips curve is wrong.

That might be a strong argument against the version of the Phillips curve that was widely believed during the 1960s (the “groovey” Phillips curve, as Gabriel Mihalache called it in an earlier comment). That version posited a stable relationship between the unemployment rate and the level of inflation, the same relationship in the long run as in the short run. The problem is, nobody believes in that version of the Phillips curve any more. Don’t even bother looking in the duffle bag. That argument was settled conclusively before Bill Gates dropped out of college.

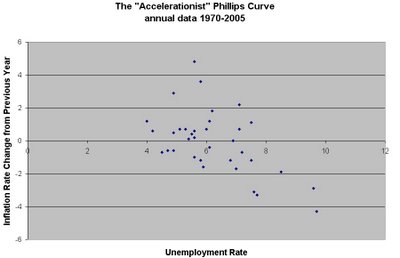

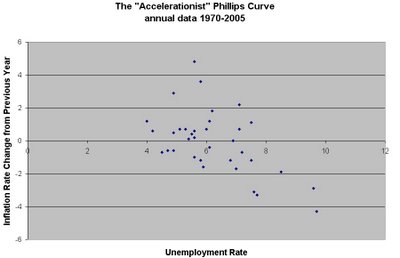

For practical purposes, the Phillips curve – the version that is used to guide forecasts and generate policy prescriptions today – is not a relationship between unemployment and the level of inflation; it is a relationship between unemployment and the change in the inflation rate. (There are subtle reasons why this practical definition isn’t exactly right, but for such a simple formulation, it comes awfully close. Econometrically speaking, the Phillips curves fit by people like empirical Phillips curve guru Robert Gordon have exactly this “accelerationist” property.)

So let’s look at the data. Suppose we don’t even bother with all the econometric subtleties that people like Robert Gordon and Mark Thoma would urge upon us. Suppose we just do a straight scatterplot. Here it is:

I don’t know about you, but that sure looks like an inverse relationship to me. Want to include the 1970s? OK.

His argument essentially goes like this: the Phillips curve is an inverse relationship between unemployment and inflation. What we observe, however, is that the relationship is positive, not inverse. Therefore the Phillips curve is wrong.

That might be a strong argument against the version of the Phillips curve that was widely believed during the 1960s (the “groovey” Phillips curve, as Gabriel Mihalache called it in an earlier comment). That version posited a stable relationship between the unemployment rate and the level of inflation, the same relationship in the long run as in the short run. The problem is, nobody believes in that version of the Phillips curve any more. Don’t even bother looking in the duffle bag. That argument was settled conclusively before Bill Gates dropped out of college.

For practical purposes, the Phillips curve – the version that is used to guide forecasts and generate policy prescriptions today – is not a relationship between unemployment and the level of inflation; it is a relationship between unemployment and the change in the inflation rate. (There are subtle reasons why this practical definition isn’t exactly right, but for such a simple formulation, it comes awfully close. Econometrically speaking, the Phillips curves fit by people like empirical Phillips curve guru Robert Gordon have exactly this “accelerationist” property.)

So let’s look at the data. Suppose we don’t even bother with all the econometric subtleties that people like Robert Gordon and Mark Thoma would urge upon us. Suppose we just do a straight scatterplot. Here it is:

I don’t know about you, but that sure looks like an inverse relationship to me. Want to include the 1970s? OK.

Labels: economics, inflation, macroeconomics, Phillips curve, unemployment

6 Comments:

I think the policy point is that the Phillips curve was supposed to allow governments to pick a "socially/politically acceptable" pair of inflation and unemployment.

Can we do that with the new curve? Yes. You need to accelerate to a desirable level of inflation and keep inflation there. But it's a lot less palatable.

And it also goes against the Tao of "price stability", the buzzword du jour, here in the ECB-and-adjacent area. So I this looks more like a forecasting tool rather than one for active policy.

As for the people that got this mess started... I guess each time a right-winger tries to deter activist policy, an angel gets his wings. I can't explain it any other way. (I sometimes hate being a "right-winger" just because of the crowd.)

P.S. I tried to replicate your plot for Romania's data, here. It sort of turns out as an positive relation, but I fear I might have plotted the wrong inflation data. Can someone check?

Excellent. Or should I say groovy?!

Knzn, you're cheating a bit here. When academics talk about a Phillips curve they typically mean the New Keynesian Phillips curve; the one with a microfoundation (calvo pricing etc). However, this curve is forward looking in that todays inflation depends on expectations of future output gaps. Overall, it doesnt fit the data. At all.

You are talking about the accelerationist curve, which is completely backward looking; its an adaptive expect model; a reduced form model; a simple rule of thumb, thats not understood. Overall, just cos it fit the data in the past, doesnt mean itll do so again - Lucas critique etc.

Basically, what Im saying is that the Phillips curve isnt as robust as you hint at. After all, if we adhered to it in the nineties, the FED would have taken the punch bowl away far too early. Besides theoretical issues, operationally, we dont know what the Nairu is, the magnitude/permanence of supply shocks etc. And, oh, Arthur Okun said it was a UFO - an unidentified flying object.

Well said.

mvpy, You make some cogent objections to the use of the Phillips curve for policy analysis (which will have to be answered elsewhere), but Kudlow’s objection is more basic, and wrong. Kudlow objects to the “sacrifice ratio” on the grounds that “unemployment and inflation have actually moved in tandem.” (As pgl points out, this isn’t even true.) But all versions of the Phillips curve in wide use today both (a) are consistent with a positive correlation between unemployment and inflation over long time periods and (b) imply a sacrifice ratio (at least when policy is not perfectly credible).

As I noted in the post, there are reasons why my practical definition of the Phillips curve isn’t exactly right. To some extent, what I’m defending is a straw man, too, but this one at least is well on his way to the Emerald City. Kudlow is talking about the Fed, not academia, and I would guess that the Fed uses the accelerationist Phllips curve as a baseline in discussing the sacrifice ratio. The discussion is presumably along the lines of, “Can we do better than the accelerationist Phillips curve implies, because our policy is credible?” You can make the theoretical point that, yes, you should be able to do a lot better, because the accelerationist Phillips curve is just a reduced form and subject to the Lucas critique. But Kudlow’s purely empirical objection is barking up the wrong tree.

moncler coat

jordan shoes

jordan 12

yeezy boost 700

yeezy

jordan shoes

moncler outlet

kd shoes

kd shoes

supreme hoodie

Post a Comment

<< Home