The Non-Accelerating Inflation Range of Unemployment

Hopefully my last two posts on the subject have made it clear that I am ready, willing, and able to defend the theory of a Non-Accelerating Inflation Rate of Unemployment, not just as “the best of a bad lot” but as a worthwhile theory in and of itself. Having declared victory, I am now getting out. Herewith I renounce the Non-Accelerating Inflation Rate of Unemployment. Le NAIRU est mort.

Vive le NAIRU! As we bury the theory, we need not also bury the acronym. Rather, let me suggest that there is a range of unemployment rates that is compatible with stable inflation: the Non-Accelerating Inflation Range of Unemployment. I’m not sure who coined that phrase, but I associate it with Harvard labor economist James Medoff. (A Google search on the phrase turns up nothing of interest.)

If the unemployment rate goes above the NAIRU range, the inflation rate declines. If it goes below, the inflation rate rises. If it stays within the range, the inflation rate remains the same, except for random changes and responses to external shocks.

It is a theory with which, it seems to me, almost everyone will eventually have to agree. It is proven by thought experiment and historical experience. Even the most ardent “Old Keynesian” or real business cycle advocate will have to acknowledge that, if we push unemployment far enough below the full-employment level, the inflation rate will start to rise fairly rapidly. To put it conversely, an inflationary monetary policy will initially push unemployment below the full-employment level. Some may deny the possibility of pushing unemployment below the full-employment level, but it seems to me that the late 1960s provide an example.

On the other side, even the most ardent Laxtonite advocate of the convex Phillips curve will have to acknowledge that, if we push unemployment high enough, we will get fairly rapid disinflation – or conversely, that there are limits to the unemployment effects of even the most draconian disinflaitonary (or deflationary) policy. The early 1980s would seem to provide an example. I might also cite the rapidity with which deflation materialized during the early 1930s, as well as the relatively small absolute unemployment increase in 1990s Japan.

And there is surely some range of unemployment in the middle that is compatible with stable inflation. Traditional NAIRU people may still claim that the range is degenerate, just a single point, but the experience of the late 1990s makes that claim very difficult to maintain.

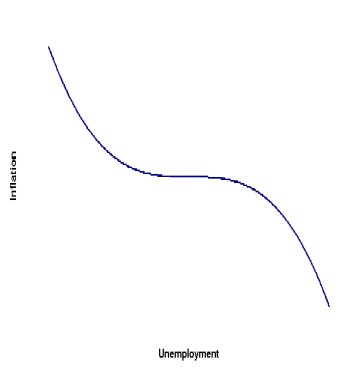

What I’m suggesting is a Phillips curve that is convex on the left side and concave on the right side, like the shape depicted below. For extremely low unemployment rates – near zero – we are in hyperinflationary territory. As we consider gradually higher unemployment rates, the inflation rate first falls quickly toward “ordinary high inflation,” then more slowly down to the expected inflation rate, where it essentially remains over a certain range. Subsequently, as we consider gradually higher unemployment rates above the NAIRU, the inflation rate falls slowly, then more quickly, then very quickly into the deflation zone.

Vive le NAIRU! As we bury the theory, we need not also bury the acronym. Rather, let me suggest that there is a range of unemployment rates that is compatible with stable inflation: the Non-Accelerating Inflation Range of Unemployment. I’m not sure who coined that phrase, but I associate it with Harvard labor economist James Medoff. (A Google search on the phrase turns up nothing of interest.)

If the unemployment rate goes above the NAIRU range, the inflation rate declines. If it goes below, the inflation rate rises. If it stays within the range, the inflation rate remains the same, except for random changes and responses to external shocks.

It is a theory with which, it seems to me, almost everyone will eventually have to agree. It is proven by thought experiment and historical experience. Even the most ardent “Old Keynesian” or real business cycle advocate will have to acknowledge that, if we push unemployment far enough below the full-employment level, the inflation rate will start to rise fairly rapidly. To put it conversely, an inflationary monetary policy will initially push unemployment below the full-employment level. Some may deny the possibility of pushing unemployment below the full-employment level, but it seems to me that the late 1960s provide an example.

On the other side, even the most ardent Laxtonite advocate of the convex Phillips curve will have to acknowledge that, if we push unemployment high enough, we will get fairly rapid disinflation – or conversely, that there are limits to the unemployment effects of even the most draconian disinflaitonary (or deflationary) policy. The early 1980s would seem to provide an example. I might also cite the rapidity with which deflation materialized during the early 1930s, as well as the relatively small absolute unemployment increase in 1990s Japan.

And there is surely some range of unemployment in the middle that is compatible with stable inflation. Traditional NAIRU people may still claim that the range is degenerate, just a single point, but the experience of the late 1990s makes that claim very difficult to maintain.

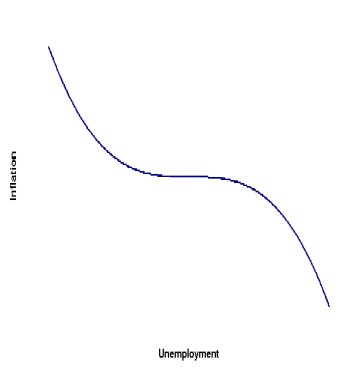

What I’m suggesting is a Phillips curve that is convex on the left side and concave on the right side, like the shape depicted below. For extremely low unemployment rates – near zero – we are in hyperinflationary territory. As we consider gradually higher unemployment rates, the inflation rate first falls quickly toward “ordinary high inflation,” then more slowly down to the expected inflation rate, where it essentially remains over a certain range. Subsequently, as we consider gradually higher unemployment rates above the NAIRU, the inflation rate falls slowly, then more quickly, then very quickly into the deflation zone.

Labels: economics, inflation, macroeconomics, NAIRU, Phillips curve, unemployment

6 Comments:

Your posts are awesome! Keep it up.

As far as I know "NAIRU" was introduced by Tobin and Keynesian friends as a replacement for Friedman's "natural rate" label which was deemed loaded with unintended connotations.

"If the unemployment rate goes above the NAIRU range, the inflation rate declines."

Look, knzn, for goodness sake, the theory you are proposing is completely vacuous. You are saying that, well, theres a range of unemployment, below which inflation will start rising. But, we dont really no what the range is. And, whats more, the range can change. I mean, what kinda theory is *this*. That said, I admit, the *range* thing is better than a *point*.

"I might also cite the rapidity with which deflation materialized during the early 1930s\"

But, deflation stopped after a while. Given the nairu gap, deflation was mild. Thats what George Akerlof says anyhow. He takes this as a refutation of the nairu thing. And from reading the last paragraph, this refutes your theory too. Look at Georges paper with Dickens, Perry on the greasing the wheels issue. This seems to be very similar in spirit to what youre doing here.

mvpy (Is it mvpy or mv=py?), the theory is no more vacuous than any other theory in the process of being fleshed out. (I presume nobody else has fleshed it out, or my Google search would have been more successful.) In the earlier posts, I discussed a theory of NAIRU shifts – a theory which fits the data quite well even in its dumb linear version. I haven’t thought yet about how to apply that theory to the non-linear NAIRU range theory, but it should be possible. So when you say, “we don’t really know what the range is,” that only means that the research isn’t finished, not that it’s pointless.

I cited the rapidity of onset of deflation during the 1930s, which was much faster than a Laxtonite would expect. You rightly point out that the subsequent progress of deflation was much slower than even a linear NAIRU guy would expect. The reason, presumably, is that the long-run Phillips curve is downward-sloping in that range. (This is the implication of the “greasing the wheels” theory.) Of course any kind of NAIRU or NAIRU theory only works to the extent that long-run Phillips curve can be approximated by a vertical line.

It occurs to me though, that I was probably wrong to sneak the assumption of symmetry into my picture. The convexity on the left side is almost certainly more severe than the concavity on the right side. (If one believed seriously in a linear Phillips curve, one would have to believe that it became infinitely convex – a kink – when it got to zero. It would also have to become infinitely concave when it got to 100%, but that’s very far away.)

酒店喝酒,禮服店,酒店小姐,酒店領檯,便服店,鋼琴酒吧,酒店兼職,酒店兼差,酒店打工,伴唱小姐,暑假打工,酒店上班,酒店兼職,ktv酒店,酒店,酒店公關,酒店兼差,酒店上班,酒店打工,禮服酒店,禮服店,酒店小姐,酒店兼差,暑假打工,酒店經紀,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,台北酒店,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,寒假打工,酒店小姐,禮服店 ,酒店小姐,酒店經紀,酒店兼差,暑假打工,酒店小姐,酒店傳播,酒店經紀人,酒店,酒店,酒店,酒店 ,禮服店 , 酒店小姐,酒店經紀,酒店兼差,暑假打工,招待所,酒店小姐,酒店兼差,寒假打工,酒店上班,暑假打工,酒店公關,酒店兼職,禮服店 , 酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工,酒店,酒店,酒店經紀,酒店領檯 ,禮服店 ,酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工, 酒店上班,禮服店 ,酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工, 酒店上班,禮服店 ,酒店小姐 ,酒店經紀 ,酒店兼差,暑假打工, 酒店上班,酒店經紀,酒店經紀,酒店經紀

ray ban sunglasses, cheap uggs, uggs, michael kors outlet, ray ban sunglasses, michael kors outlet, prada handbags, ugg boots clearance, oakley sunglasses cheap, longchamp handbags, air max, michael kors outlet, jordan shoes, polo ralph lauren, gucci outlet, christian louboutin, replica watches, louboutin shoes, louis vuitton, ray ban sunglasses, polo ralph lauren outlet, kate spade outlet, burberry outlet, tiffany and co, louis vuitton outlet, louboutin, nike shoes, oakley sunglasses, air max, uggs outlet, cheap oakley sunglasses, tory burch outlet, louis vuitton handbags, ugg outlet, longchamp handbags, louboutin outlet, rolex watches, michael kors outlet, michael kors outlet online sale, burberry outlet, louis vuitton outlet stores, prada outlet, tiffany and co, oakley sunglasses, chanel handbags, longchamp outlet

michael kors, air max pas cher, kate spade handbags, longchamp, true religion outlet, nike free pas cher, ralph lauren, abercrombie and fitch, coach purses, lululemon outlet online, sac burberry, louboutin, air jordan, nike air max, sac longchamp pas cher, timberland, nike roshe run pas cher, coach outlet, nike roshe, air max, true religion jeans, nike free, nike tn, polo ralph lauren, nike blazer, replica handbags, polo lacoste, oakley pas cher, ray ban sunglasses, ray ban pas cher, vanessa bruno, hogan outlet, mulberry, converse pas cher, michael kors outlet, michael kors pas cher, vans pas cher, sac hermes, true religion outlet, coach outlet store online, hollister, true religion jeans, michael kors uk, air max, new balance pas cher, nike air force, sac guess, north face, north face, hollister

Post a Comment

<< Home